Fourteen Elephants on a Steel Bridge

Exploring the Three Waves of Innovation: Extract, Expand, and Entrench

"We look at the present through a rear-view mirror. We march backwards into the future. If you want to look ahead, you have to look twice as far back, because the future is the result of past actions."- Marshall McLuhan

"Innovation is hard because solving problems people didn’t know they had and building something no one needs look identical at first." – Aaron Levie

Audere Capital invests as the first checks into advanced technology companies. Our team of repeat founders and investors works directly with experienced entrepreneurs, corporate partners, and governments to build and scale cutting-edge startups.

We invite you to FOLLOW AUDERE ON LINKEDIN or connect with us directly at info@audere.capital.

THE THREE WAVES OF INNOVATION

The graveyards of the world are full of innovative tech startups. Time and time again, we hear pitches from founders who have built the only solution (except for the others that pitched us that week) that solves a large problem (that was somehow previously undiscovered) for an unseen army of customers with ready cash (a category of people that we have yet to meet).

The interesting thing about these meetings is that success in startups actually requires far more than a significant innovation. If Newton and Leibnitz can independently discover calculus, it stands to reason that most other ideas will occur to more than one founder. And that’s actually a good thing. The idea is only the beginning.

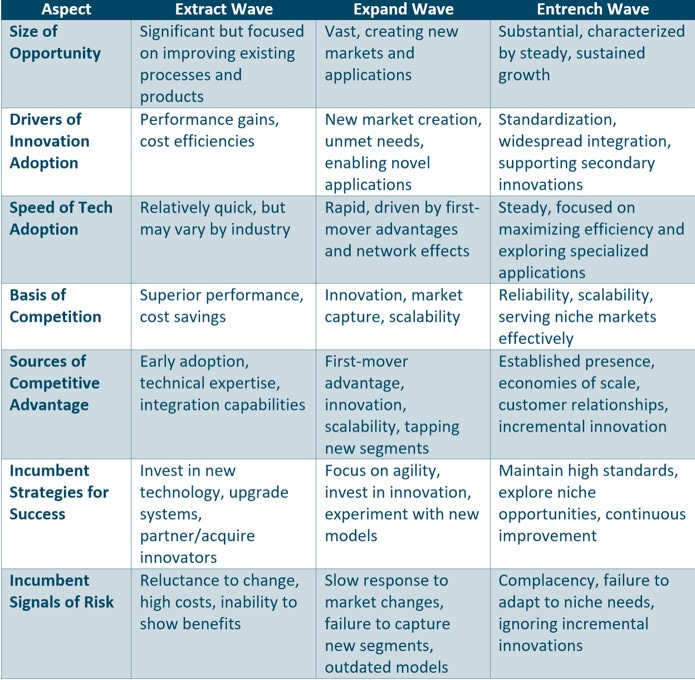

To understand who will drive lasting value creation and who will not, we think about three successive waves of early technology adoption. The first wave of initial adoption is driven by performance gains and cost efficiencies (Extract Wave). The second wave is driven by the emergence of new applications and markets (Expand Wave). The third wave is driven by standardization and scale of a technology as it becomes a foundational platform upon which further innovations and niche applications will be built (Entrench Wave).

Each wave brings unique challenges and opportunities, shaping the trajectory of technological progress and economic growth. There are absolutely patterns, which is why we find history to be so useful. But by no means is the evolution of technologies and the companies that build them predictable, linear, or even logical.

In fact, sometimes, it’s an outright circus.

THE FIRST WAVE: FOURTEEN ELEPHANTS ON A BRIDGE

On June 14, 1874, steel manufacturer Andrew Carnegie orchestrated a dramatic demonstration by leading 14 elephants across the newly constructed Eads Bridge over the Mississippi River. This spectacle was more than mere showmanship; it was a calculated move to showcase the strength and reliability of steel in large-scale construction.

Carnegie, known for his business acumen and eye for emerging technologies, recognized steel's potential in modern infrastructure, particularly for the expanding railroad industry. In 1870, while in Europe, he learned about the Bessemer process - a revolutionary method for mass-producing steel by blowing air through molten iron to remove impurities. This process dramatically reduced the cost and time required to produce steel.

Carnegie founded his first steel mill in 1872. The startup venture faced numerous challenges; managing raw material quality and adapting the Bessemer process to American iron ore was vastly more complex than expected. After years of struggle, the mill finally produced viable steel.

Ever the risk-taker, Carnegie immediately gambled the future of the company on a massive project: building the biggest steel bridge in the world.

GAMBLING ON AN IMPOSSIBLE BRIDGE

By the mid-19th century, America’s industrial economy was booming, and St. Louis had become a major trade hub. But the city’s growth was severely constrained by the lack of a reliable bridge over the Mississippi River. The challenge was significant: the Mississippi had strong and shifting currents, required high elevation for commercial shipping, and was incredibly wide.

James B. Eads, an engineer known for his innovative work on ironclad warships during the Civil War, was selected to design and oversee the bridge's construction. Eads decided to use steel, which offered significant advantages in strength and durability. It is worth noting that this approach was one of many instances in US history in which military training and government developed technology spurred commercial innovation (looking at you, microwave, GPS, and internet!).

The steel bridge is one of many instances in

which US military training and government technology spurred commercial innovation.

For Carnegie, securing the contract to supply steel for the Eads Bridge was a risk. He had committed to deliver significant quantities of advanced grade steel while his manufacturing capabilities were still being perfected. The high-profile project offered an unparalleled opportunity to showcase his steel's quality and advantages, but if he failed, the company would be ruined.

I KNOW ALL ABOUT THE RUMORS. I STARTED THEM.

Given the novelty of using steel in such a massive structure, public doubt about its safety grew. The bridge's central span measured an enormous 520 feet, the longest arch span in the world at that time, and there were increasing rumblings that it would collapse.

A superstition began circulating St. Louis that large animals could sense unsafe structures and would refuse to cross. People questioned whether their horses would be willing to pull carriages over the bridge.

With concerns mounting, Carnegie announced that he actually believed the superstition that large animals could sense if a bridge was unstable. To prove once and for all that his steel was strong, he would lead a parade of 14 elephants across the bridge.

The sight of the massive animals confidently traversing the structure provided a powerful visual testament to its stability. The demonstration was a sensational success and garnered national media attention, effectively showcasing the bridge's safety and the quality of Carnegie's steel to all of America. It was a turning point for the business.

Years later, Carnegie admitted that there was never any merit to the superstition that Elephants could sense unstable structures. And he would know. He was the one who had started the rumors in the first place…

THE FIRST WAVE: EXTRACTING VALUE THROUGH EFFICIENCY

We think of the first cycle of innovation as an Extraction Wave. New technologies deliver benefits over existing solutions, driving value compression and transfer from inferior to superior offerings. First wave returns come from the extraction of value from high margin legacy incumbents to newer technology providers that reduce costs.

First wave returns come from the extraction of value from high margin legacy incumbents to newer technology providers that reduce costs.

The First Wave also serves to validate and popularize new technologies by testing them against trusted legacy solutions. For Carnegie, the first wave established steel as the material of choice for critical infrastructure and highlighted its cost and performance benefits. It also provided the manufacturing, distribution, and specialized workforce to deliver steel at scale. The first wave proves out the market and positions a technology for explosive growth.

However, it is common for this first wave to be limited in potential market return. Existing processes can only be improved so much. In any market space large or small, there is only so much share of wallet to be distributed. Railways and bridges had a defined limit. One does not need multiple bridges across the same river, or multiple rail lines across the same territory. The first wave is at its core a zero-sum fixed pie market.

THE SECOND WAVE: EXPANSION INTO VERTICAL RAILROADS

In our view, the most significant and rapid value creation occurs in what we think of as the Expand Wave. In this second wave, new but trusted technologies unlock previously impossible markets and use cases, creating an entirely new strategic landscape characterized by explosive growth.

In the second wave, new but proven technologies unlock previously impossible markets and use cases that are massive

It was steel's use in skyscrapers that expanded the industry by an order of magnitude. Demand for steel exploded as it revolutionized urban landscapes and allowed cities to grow vertically. This vertical expansion required vast amounts of steel, far exceeding the capacity constrained demand from railroads and bridges.

Competition in second waves can be very different from the prior wave because they unlock completely new opportunities. In an open market, aggressive growth, business model creativity, and strategic partnerships become as valuable as technological edge. Second waves are also longer running. The construction of skyscrapers represented a vast new market with a sustained appetite for steel that continues to the present.

THE THIRD WAVE: ENTRENCHING STEEL AS A FOUNDATIONAL PLATFORM

The Third Wave is one of entrenchment. The standardization and optimization of a technology at scale allows other innovation industries to build on top of the core capability. In the case of steel, the Entrenched Wave continued to lower cost and improve quality, which in turn unlocked steel's reliability and versatility to a wide variety of niche applications from appliances to aviation.

In the third wave, standardization, consolidation, and optimization allow other industries to build on top of the core technology.

As the steel industry matured, Carnegie sold his operations to J.P. Morgan, who consolidated the industry into U.S. Steel. This move towards optimization is a hallmark of the Economy Wave. In this instance, Morgan ensured steel became a standardized foundational platform for other innovations and niche applications. U.S. Steel set industry standards, ensuring consistency and quality, which facilitated steel's widespread use in numerous products and industries.

During the Third Wave we typically anticipate consolidation as well. The creation of U.S. Steel exemplifies how a technology can transition from a disruptive innovation to a foundational utility, enabling further advancements and economic growth on a slower growth but massive addressable market.

EXAMPLES OF THE WAVES

The story of U.S. Steel is just one example of a groundbreaking technology innovation that traveled through these waves. Similar patterns can be observed in other industries:

Standard Oil: Replaced whale oil with kerosene (Extract), provided oil to newly invented automobile companies (Expand), and facilitated the development of standardized refining, distribution, specialty petrochemical products, and regulatory capture (Entrench).

Amazon: Moved from at scale ecommerce (Extract) to providing cloud infrastructure (Expand), and became a diversified platform for e-commerce, entertainment, and technology services (Entrench).

Microsoft: Evolved from operating systems (Extract) to applications (Expand) to a broad platform of software and cloud services integrated across the technology ecosystem (Entrench).

Netflix: Transformed media consumption with DVD rental (Extract), pioneered streaming services and original content (Expand), and became a dominant platform for media production and distribution (Entrench).

LEVERAGING THE THREE-WAVE MODEL

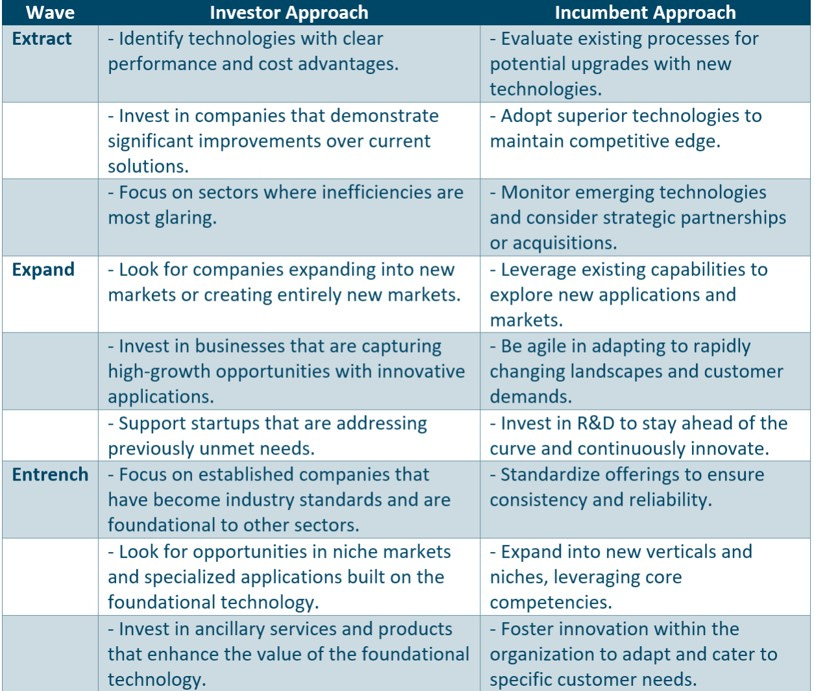

Understanding and leveraging this model can provide venture investors and large corporations with a strategic advantage in navigating technological advancements.

For Venture Investors:

Extract Wave: Seek startups demonstrating clear performance improvements and cost efficiencies over existing solutions.

Expand Wave: Focus on companies pioneering new markets or applications, characterized by rapid growth and high margins.

Entrench Wave: Look for established companies that have become foundational platforms, offering stable returns and long-term growth potential.

For Large Corporations:

First Wave - Extract: Focus on adopting and integrating new technologies that offer clear benefits over existing processes.

Second Wave - Expand: Be agile in exploring new markets and applications, potentially through diversification, geographic expansion, and M&A activities.

Third Wave - Entrench: Standardize offerings, focus on continuous improvement, and remain vigilant for signs of complacency.

CONCLUSION

Understanding innovation waves is crucial for anticipating technological progress and economic growth. The journey of Andrew Carnegie, from adopting the Bessemer process to his role in creating U.S. Steel, exemplifies these waves and provides valuable insights into them. By recognizing and strategically navigating each wave, both incumbents and investors can capitalize on opportunities and mitigate risks associated with technological advancements.

In today's rapidly evolving technological landscape, this three-wave model is highly relevant. From artificial intelligence and blockchain to renewable energy and biotechnology, emerging technologies are likely to follow similar patterns of extract, expand, and entrench. By anticipating these waves, entrepreneurs and investors can correctly position themselves to capture value at each stage of technological evolution, driving innovation and economic growth in the process.

As we look to the future, it's clear that the ability to navigate these waves will be a key differentiator for successful companies and investors. Those who can anticipate and adapt to each phase of technological development will be best positioned to thrive in an increasingly complex and dynamic global economy.

Our mission is to fund, build, and scale critical technology companies. Don’t hesitate to reach out or to FOLLOW AUDERE ON LINKEDIN.

As always, build boldly and dare to be first.

Peter & Maggie